The Single Strategy To Use For Transaction Advisory Services

Table of ContentsWhat Does Transaction Advisory Services Do?An Unbiased View of Transaction Advisory ServicesThe 3-Minute Rule for Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For AnyoneTransaction Advisory Services for Dummies

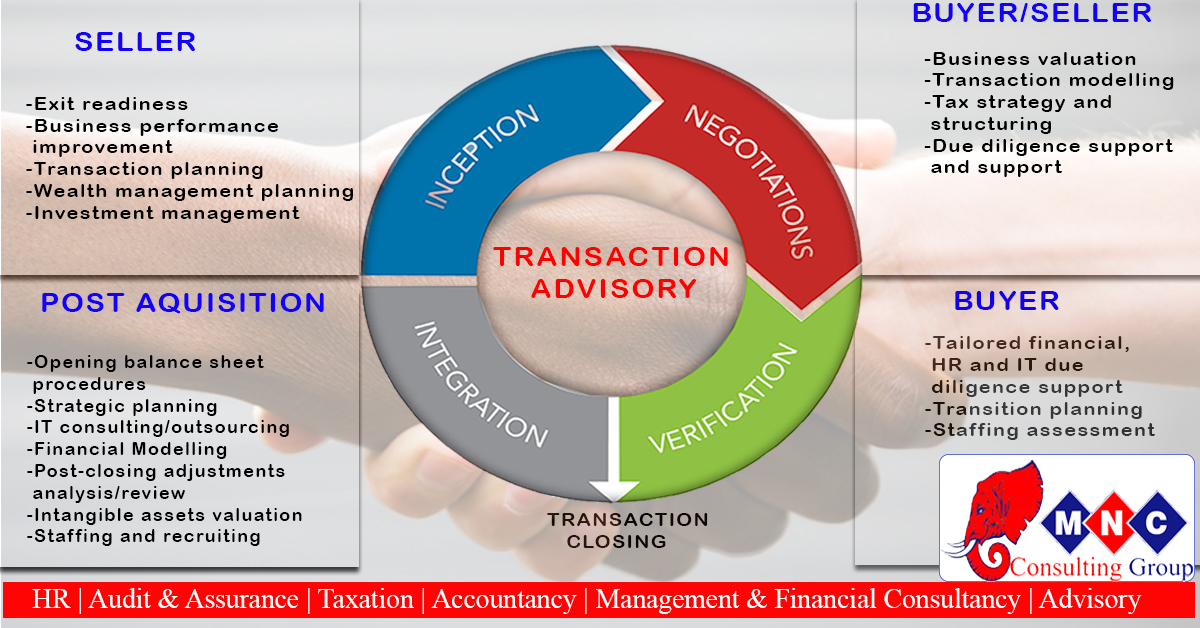

This action makes sure the organization looks its finest to potential purchasers. Obtaining the organization's value right is vital for a successful sale.Deal consultants action in to assist by obtaining all the required info organized, answering questions from customers, and preparing sees to the company's location. Purchase experts use their experience to aid business owners manage hard arrangements, satisfy purchaser assumptions, and framework deals that match the proprietor's objectives.

Meeting legal rules is crucial in any kind of company sale. They aid company proprietors in planning for their next actions, whether it's retirement, beginning a brand-new venture, or managing their newly found riches.

Purchase experts bring a wealth of experience and knowledge, guaranteeing that every aspect of the sale is taken care of professionally. With tactical prep work, valuation, and arrangement, TAS aids company owners achieve the highest possible sale cost. By ensuring legal and regulative compliance and managing due diligence together with other offer employee, purchase experts decrease possible threats and responsibilities.

Not known Factual Statements About Transaction Advisory Services

By comparison, Huge 4 TS teams: Service (e.g., when a possible purchaser is carrying out due persistance, or when a bargain is closing and the purchaser requires to integrate the firm and re-value the vendor's Equilibrium Sheet). Are with costs that are not linked to the deal shutting efficiently. Make fees per engagement somewhere in the, which is less than what investment banks gain even on "small bargains" (however the collection possibility is also a lot greater).

The interview questions are really similar to investment financial interview questions, yet they'll concentrate much more on accounting and evaluation and much less on topics like LBO modeling. Expect concerns regarding what the Adjustment in Working Resources means, EBIT vs. EBITDA vs. Take-home pay, and "accountant just" subjects like trial equilibriums and exactly how to go through occasions making use of debits and debts as opposed to monetary statement adjustments.

The Best Guide To Transaction Advisory Services

Specialists in the TS/ FDD teams may additionally try this web-site interview management regarding whatever above, and they'll compose a detailed record with their searchings for at the end of the procedure.

, and the basic form looks like this: The entry-level function, where you do a lot of data and economic evaluation (2 years for a promotion from here). The next level up; similar job, however you get the more intriguing little bits (3 years for a promotion).

In specific, it's challenging to obtain advertised past the Manager level because few people leave the job at that stage, and you require to begin revealing proof of your capability to generate revenue to advancement. Let's start with the hours and way of living because those are much easier to define:. There are periodic late nights and weekend break work, yet absolutely nothing like the frenzied nature of financial investment financial.

There are cost-of-living adjustments, so anticipate lower compensation if you're in a more affordable location outside major monetary (Transaction Advisory Services). For all settings except Partner, the base wage consists of the bulk of the complete payment; the year-end perk may be a max of 30% of your base wage. Typically, the most effective means to raise your earnings is to switch to a different firm and work out for a higher income and incentive

Transaction Advisory Services Things To Know Before You Get This

You could enter business advancement, but investment banking obtains a lot more tough at this stage because you'll be over-qualified for Expert duties. Business finance is still an option. At this phase, you need to simply stay More Help and make a run for a Partner-level function. If you intend to leave, possibly transfer to a client and perform their appraisals and due persistance in-house.

The major issue is that because: You generally need to join one more Big 4 team, such as audit, and work there for a couple of years and then relocate into TS, job there for a few years and afterwards move right into IB. And there's still no guarantee of winning this IB function because it depends on your area, clients, and the hiring market at the time.

Longer-term, there is also some risk of and since assessing a firm's historical economic info is not exactly rocket scientific research. Yes, people will certainly constantly need to be entailed, however with more innovative technology, lower head counts might potentially sustain client engagements. That stated, the Transaction Solutions group beats audit in terms of pay, work, and exit opportunities.

If you liked this post, you could be interested in analysis.

Transaction Advisory Services for Beginners

Create sophisticated economic frameworks that aid in establishing the real market price of a company. Give consultatory work in relationship to organization evaluation to assist in bargaining and rates frameworks. Discuss the most ideal type of the deal and the sort of factor to consider to employ (cash, stock, earn out, and others).

Develop action prepare for threat and direct exposure that have actually been identified. Carry out integration preparation to establish the procedure, system, and business changes that might be required after the deal. Make numerical estimates of integration costs and benefits to assess the economic rationale of combination. Establish guidelines additional reading for incorporating departments, innovations, and business processes.

Evaluate the possible customer base, market verticals, and sales cycle. The operational due persistance offers crucial insights into the performance of the firm to be gotten worrying risk evaluation and worth development.